15+ oklahoma payroll calculator

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Which is equal to both the employee and employer portions of the FICA taxes 153 total.

How To Save Tax On Salary 15 Tax Saving Options For Salaried Individuals

This 1500 Salary Example for Oklahoma is based on a single filer with an annual salary of 1500 filing their 2022 tax return in Oklahoma in 2022.

. Discover ADP Payroll Benefits Insurance Time Talent HR More. Figure out your filing status. As the employer you must also match your employees contributions.

Important note on the salary paycheck calculator. Back to Payroll Calculator Menu 2013 Oklahoma Paycheck Calculator - Oklahoma Payroll Calculators - Use as often as you need its free. Ad Process Payroll Faster Easier With ADP Payroll.

Get honest pricing with Gusto. Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma paycheck calculator. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Switch to Oklahoma hourly calculator. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Ad No more surprise fees from other payroll providers.

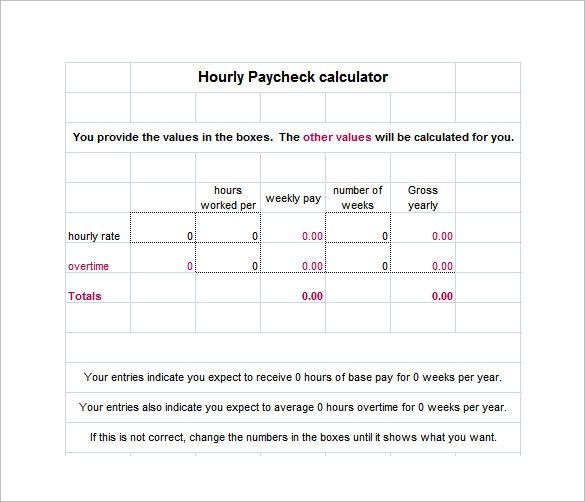

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. However you can also claim a tax credit of up to. Indicate your choices then select the Calculate button.

Thats where our paycheck calculator comes in. The maximum an employee will pay in 2022 is 911400. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Get full-service payroll automatic tax calculations and compliance help with Gusto. Payroll So Easy You Can Set It Up Run It Yourself.

With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. This income tax calculator can help estimate your average income tax rate and your take home pay. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Tax rates range from 025 to 475. Get Started With ADP Payroll. Free Unbiased Reviews Top Picks.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Ad Compare This Years Top 5 Free Payroll Software. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Oklahoma residents only.

Calculating your Oklahoma state income tax is similar to the steps we listed on our Federal paycheck calculator. This allows you to review how. You can alter the salary example to illustrate a different filing status or show an alternate tax year.

Payroll pay salary pay check payroll tax calculator tax calculators salary calculator take home pay calculator payroll. Oklahoma City OK 73105. Oklahoma Office of Management and Enterprise Services 2401 N Lincoln Blvd.

This Oklahoma hourly paycheck calculator is perfect for those who are paid on an hourly basis. Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The state income tax rate in Oklahoma is progressive and ranges from 025 to 475 while federal income tax rates range from 10 to 37 depending on your income.

Ad Get Started Today with 3 Months Free. Details of the personal income tax rates used in the. Remember that this amount is deducted from the generous Benefit Allowance provided.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. To compute benefit designations that appear on your payroll advice statement follow the boxes below. The Oklahoma Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Oklahoma State Income Tax Rates and Thresholds in 2022.

It is not a substitute for the advice of an accountant or other tax professional. The Paycheck Calculator may not account for every. Single filers will pay the top rate after earning 7200 in taxable income per year.

Get Started With ADP Payroll. Get Your Quote Today with SurePayroll. The standard FUTA tax rate is 6 so your max contribution per employee could be 420.

Ad Process Payroll Faster Easier With ADP Payroll. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Work out your adjusted gross income Net income Adjustments.

So the tax year 2022 will start from July 01 2021 to June 30 2022. All Services Backed by Tax Guarantee.

How To Calculate Payroll Taxes Wrapbook

Choctaw Nation Of Oklahoma Director Salaries Glassdoor

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

University Of Oklahoma Assistant Professor Salaries Glassdoor

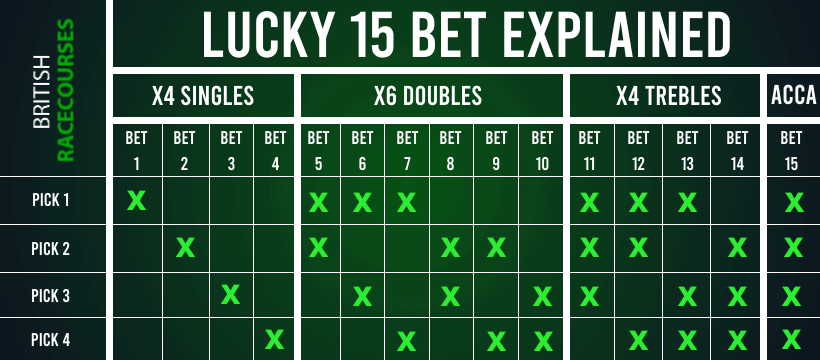

Lucky 15 Calculator Free Calculator For Your Winning Bets

Oklahoma Paycheck Calculator Smartasset

Marriage To Divorce Ratio In The U S Geographic Variation 2020

Seer Savings Calculator 13 Vs 14 Vs 15 Vs 16 Vs 18 Seer

The Links At Oklahoma City Apartments 700 Ne 122nd Street Oklahoma City Ok Rentcafe

Free Paycheck Calculator Hourly Salary Usa Dremployee

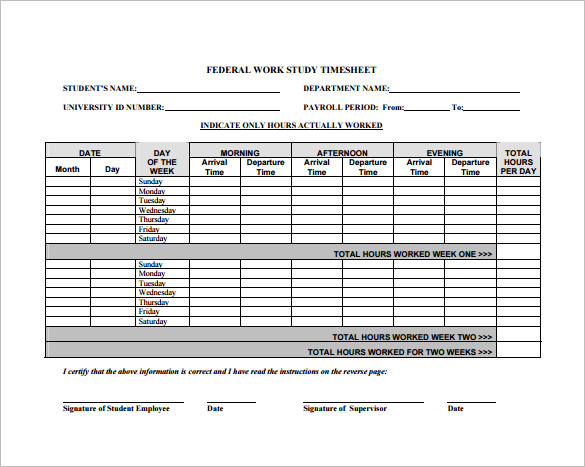

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

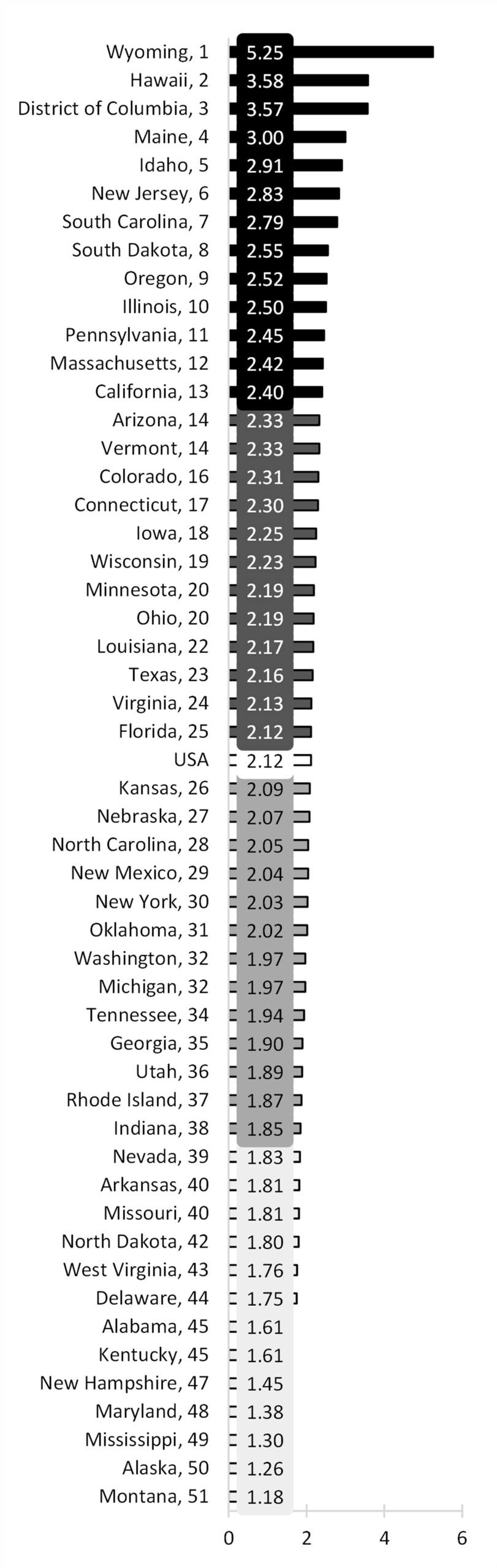

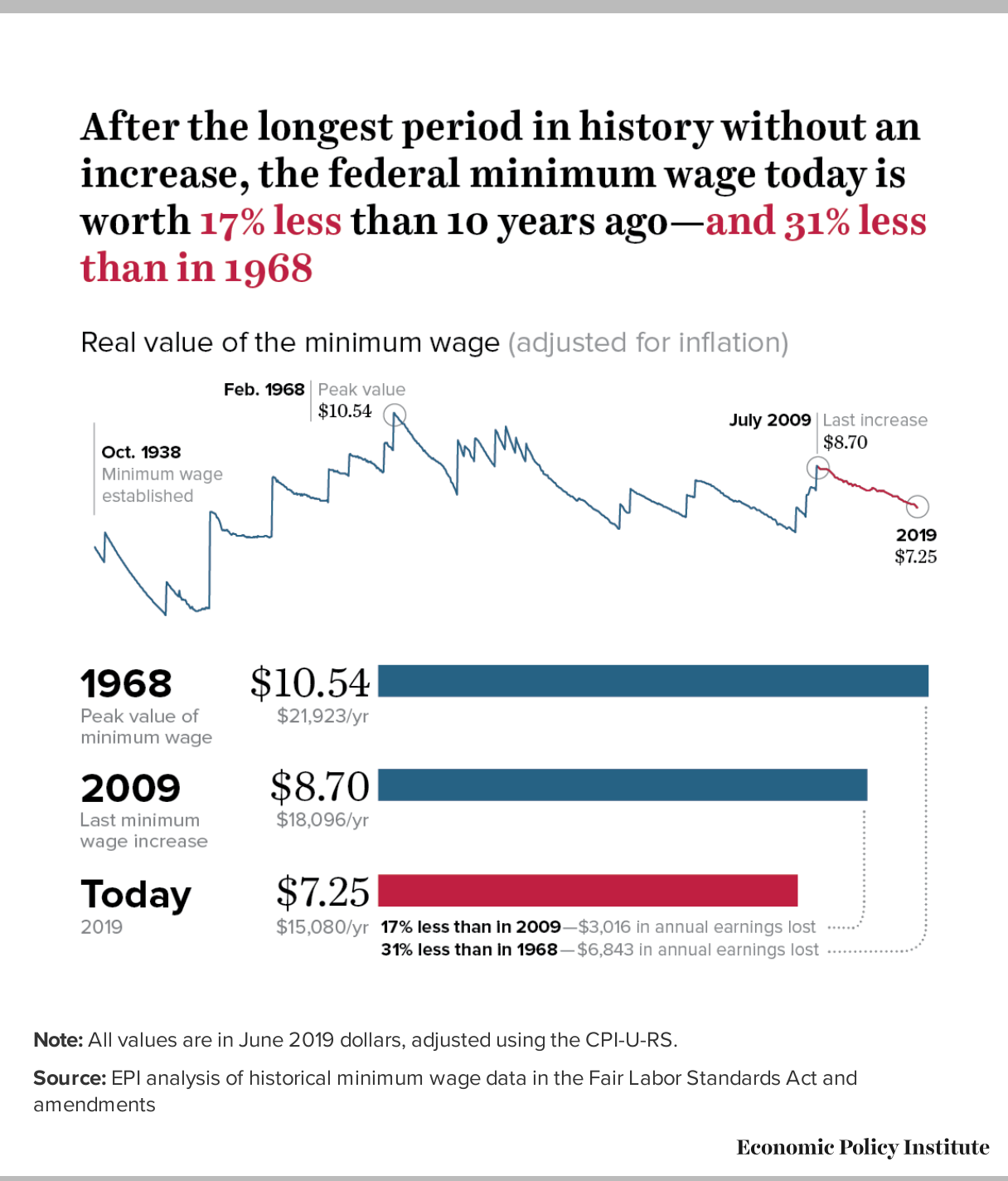

Labor Day 2019 Low Wage Workers Are Suffering From A Decline In The Real Value Of The Federal Minimum Wage Economic Policy Institute

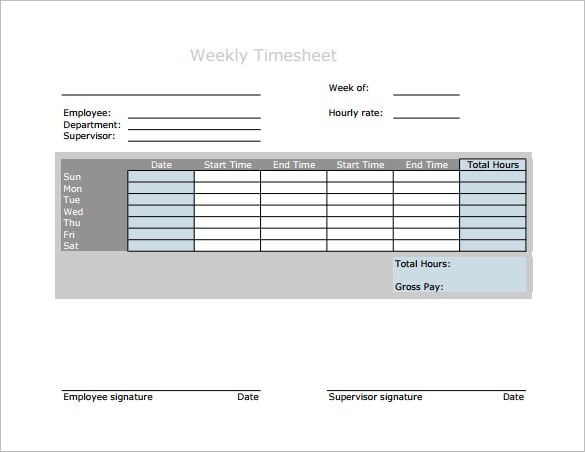

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Take Home Pay Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates